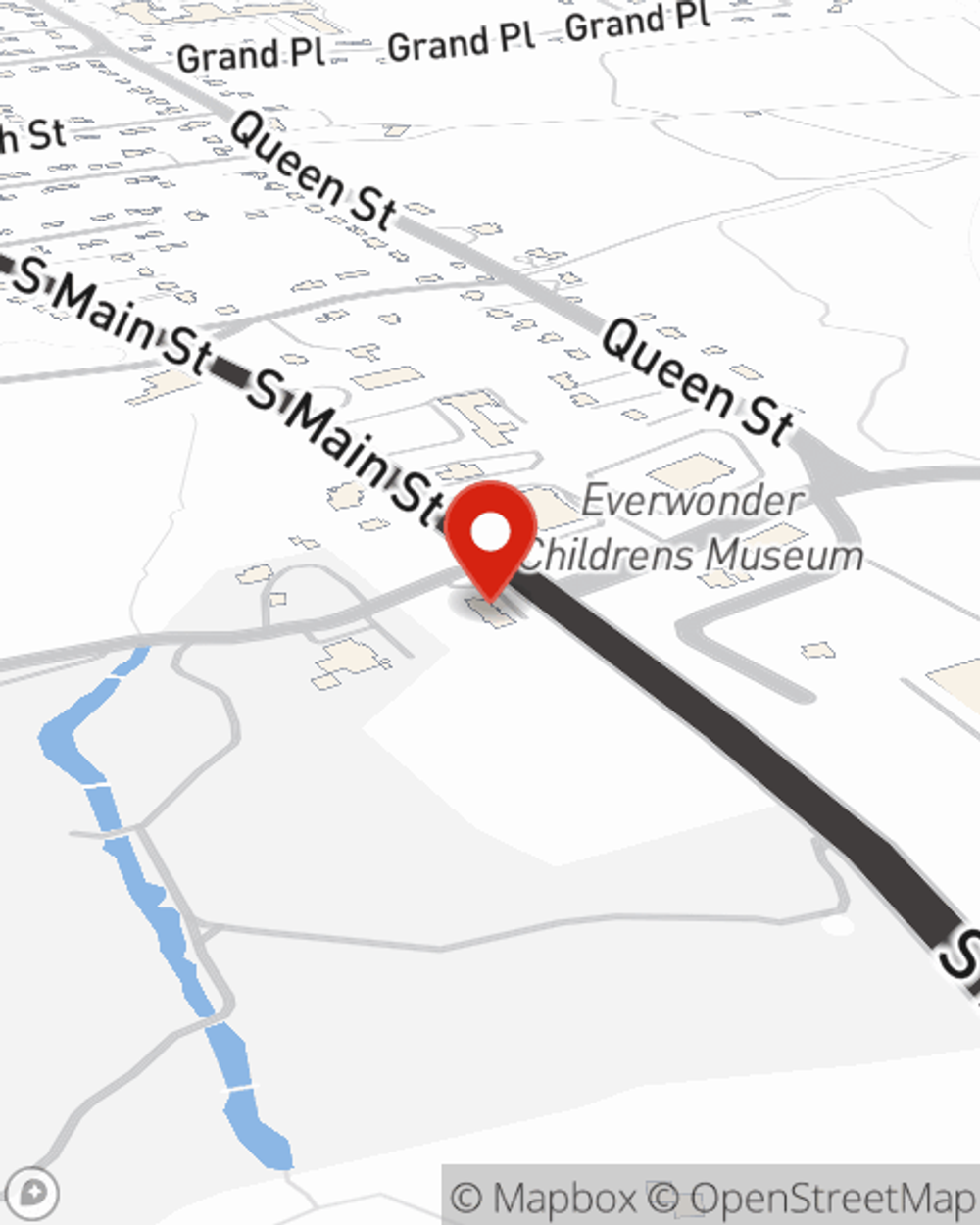

Business Insurance in and around Newtown

Calling all small business owners of Newtown!

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

Do you own an insurance agency, a pharmacy or a camping store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on your next steps.

Calling all small business owners of Newtown!

Cover all the bases for your small business

Cover Your Business Assets

When one is as enthusiastic about their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for commercial auto, worker’s compensation, artisan and service contractors, and more.

Let's talk business! Call Sarah De Jesus today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Sarah De Jesus

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.