Renters Insurance in and around Newtown

Welcome, home & apartment renters of Newtown!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented townhome or home, you should have renters insurance—especially if you own items that would be difficult to fix or replace. It's coverage for the things you do own, like your clothing and lamps... even your security blanket. You'll get that with renters insurance from State Farm. Agent Sarah De Jesus can roll out the welcome mat with the dedication and skill to help you insure your precious valuables. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Welcome, home & apartment renters of Newtown!

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Renters frequently underestimate the cost of replacing their belongings. Just because you are renting a apartment or townhome, you still own plenty of property and personal items—such as a cooking set, set of favorite books, stereo, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why buy your renters insurance from Sarah De Jesus? You need an agent who wants to help you examine your needs and evaluate your risks. With personal attention and wisdom, Sarah De Jesus stands ready to help you keep your belongings protected.

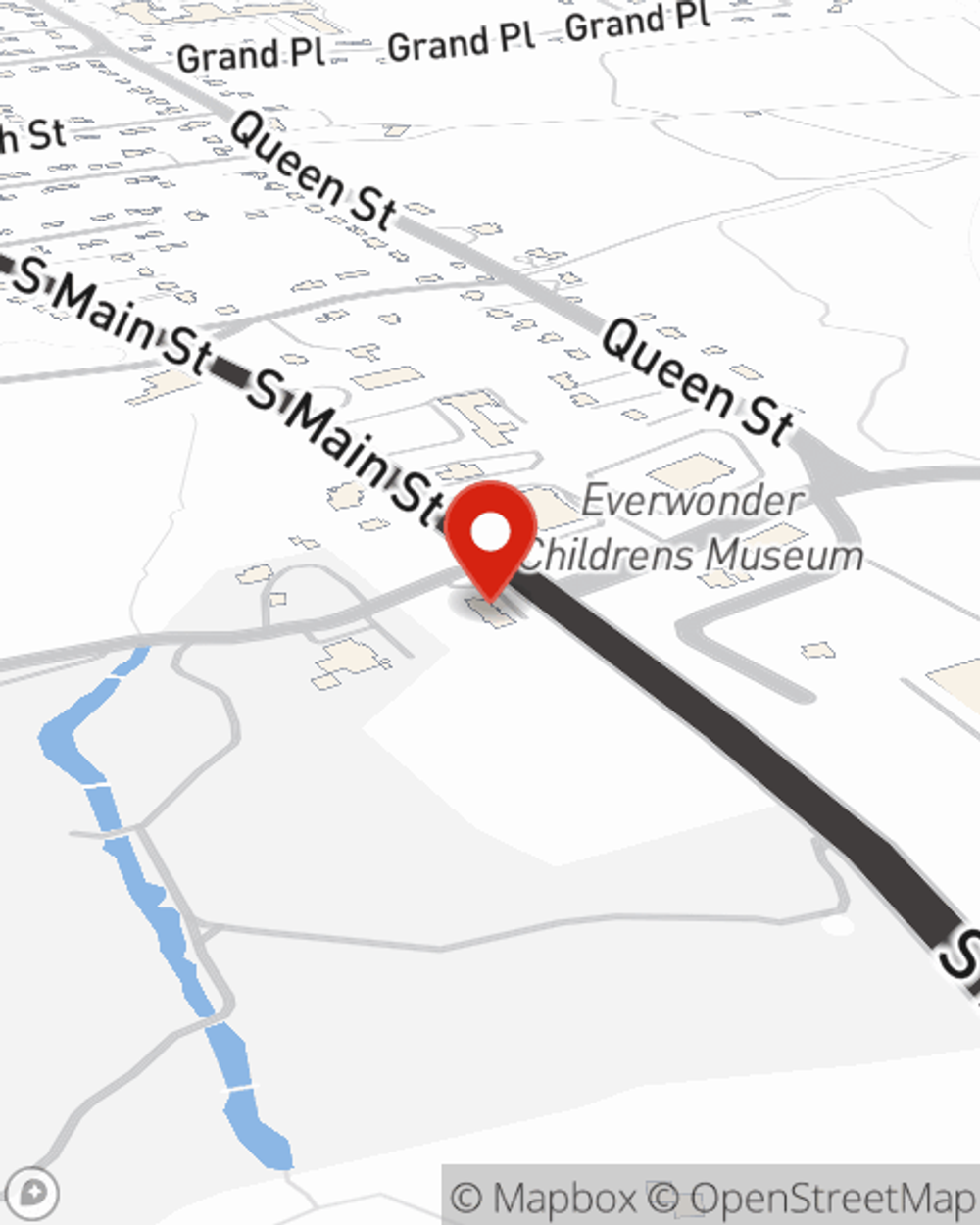

Renters of Newtown, visit Sarah De Jesus's office to explore your particular options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Sarah at (203) 447-4088 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Sarah De Jesus

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.